Diversified Investment Ideas for Low-Risk Returns sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset.

As we delve deeper into the world of investment strategies, we explore various avenues that promise low-risk returns, providing readers with valuable insights and guidance for their financial endeavors.

Overview of Diversified Investment Ideas for Low-Risk Returns

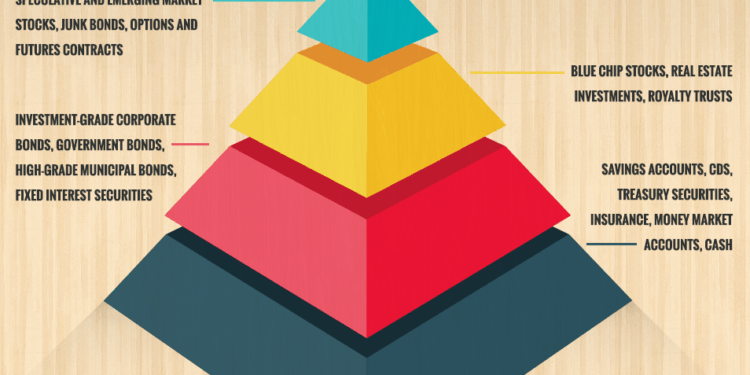

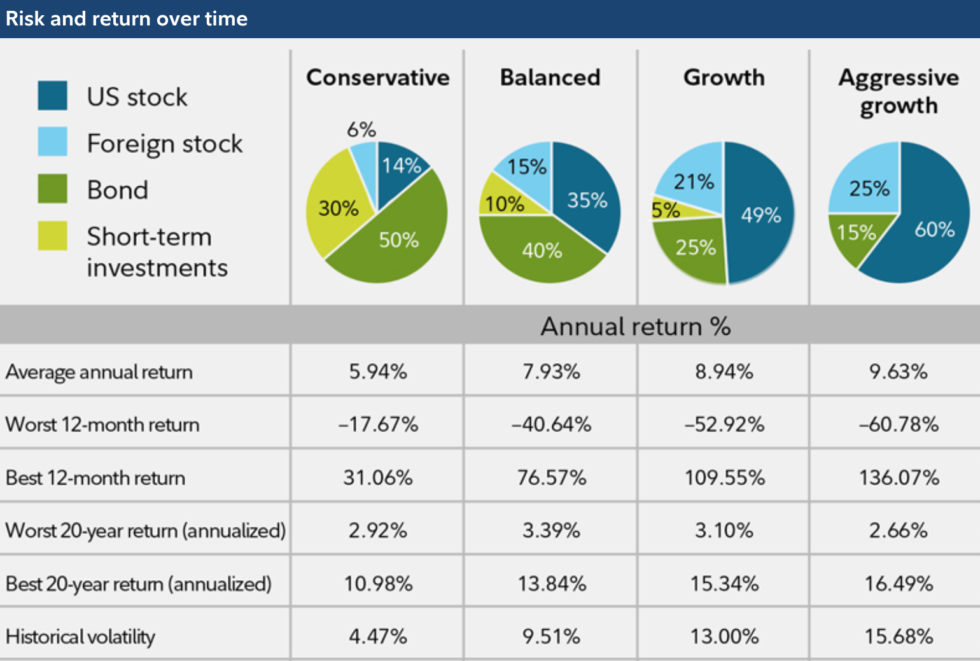

When it comes to investing, diversification is a key strategy that involves spreading your investments across different asset classes to manage risk. By not putting all your eggs in one basket, you reduce the impact of market volatility on your overall portfolio.

Seeking low-risk returns in investment strategies is important for investors who prioritize capital preservation and steady, consistent growth over high-risk, high-reward opportunities. While low-risk investments may offer lower potential returns, they provide stability and security, especially during economic downturns or market fluctuations.

Asset Classes Suitable for Low-Risk Returns

- 1. Bonds: Government bonds, municipal bonds, and corporate bonds are popular choices for low-risk investments. They provide a fixed income stream and are considered less volatile compared to stocks.

- 2. Certificates of Deposit (CDs): CDs are low-risk investments offered by banks with a fixed interest rate for a specific term. They are insured by the FDIC, making them a safe option for investors.

- 3. Treasury Securities: Treasury bills, notes, and bonds issued by the U.S. government are considered low-risk investments as they are backed by the full faith and credit of the government.

- 4. Money Market Funds: These funds invest in short-term, low-risk securities like Treasury bills and commercial paper. They aim to preserve capital and provide liquidity to investors.

Bonds as a Low-Risk Investment Option

When it comes to low-risk investment options, bonds are often a popular choice among investors. Bonds are essentially debt securities issued by governments, corporations, or municipalities to raise capital. Investors who purchase bonds are essentially lending money to the issuer in exchange for periodic interest payments and the return of the principal amount at maturity.

Types of Bonds and Risk-Return Profile

Bonds can be classified into different categories based on the issuer and other factors. Here are some common types of bonds and their risk-return profiles:

- Government Bonds:These are considered the safest type of bonds as they are backed by the government's ability to tax its citizens to repay the debt. They typically offer lower returns compared to other types of bonds but are very low risk.

- Corporate Bonds:Issued by corporations to raise capital, corporate bonds offer higher returns than government bonds but also come with a higher level of risk. The creditworthiness of the issuing company plays a significant role in determining the risk associated with corporate bonds.

- Municipal Bonds:These bonds are issued by state and local governments to fund public projects. Municipal bonds are exempt from federal taxes and sometimes state taxes, making them attractive to investors in higher tax brackets. They generally fall between government and corporate bonds in terms of risk and return.

Diversification in Bond Investments

Diversifying bond investments across different types of bonds can help mitigate risk

Real Estate Investment Trusts (REITs) for Low-Risk Returns

Investing in Real Estate Investment Trusts (REITs) can provide investors with an opportunity to gain exposure to the real estate market without the risks associated with direct property ownership.REITs are companies that own, operate, or finance income-generating real estate across a range of property sectors.

By investing in REITs, individuals can benefit from rental income, capital appreciation, and diversification without the need to purchase physical properties themselves.

Benefits of Investing in REITs

- Stable Income: REITs typically distribute a significant portion of their income to shareholders in the form of dividends, providing a steady stream of income.

- Liquidity: Unlike owning physical properties, which can take time to sell, REITs can be bought and sold on the stock exchange easily, offering liquidity to investors.

- Diversification: REITs invest in various types of real estate assets, such as residential, commercial, and retail properties, allowing investors to diversify their portfolio and reduce risk.

- Professional Management: REITs are managed by experienced professionals who handle property management, leasing, and other operational aspects, relieving investors of these responsibilities.

Dividend-Paying Stocks for Low-Risk Returns

Dividend-paying stocks are a popular choice for investors seeking low-risk returns. These stocks belong to companies that distribute a portion of their profits to shareholders in the form of dividends. This can provide a steady income stream while also potentially offering capital appreciation over time.

Key Metrics for Selecting Dividend-Paying Stocks

When selecting dividend-paying stocks for a diversified portfolio, investors should consider key metrics such as:

- Dividend Yield: The percentage of the stock price that is paid out as dividends annually.

- Payout Ratio: The proportion of earnings paid out as dividends, indicating whether the dividend is sustainable.

- Dividend Growth Rate: The rate at which dividends have been increasing over time, reflecting the company's strength.

- Dividend History: Consistent dividend payments over several years can indicate financial stability.

Industries Known for Stable Dividend Payments

Certain industries are known for their stable dividend payments, providing investors with a reliable income source. Examples include:

- Utilities: Companies in the utilities sector often have stable cash flows and pay attractive dividends.

- Consumer Staples: Companies that produce essential goods like food, beverages, and household products tend to offer steady dividends.

- Healthcare: Healthcare companies with established products and services can be reliable dividend payers.

- Telecommunications: Telecom companies with subscription-based revenue models are known for consistent dividends.

Conclusion

In conclusion, Diversified Investment Ideas for Low-Risk Returns presents a roadmap to financial success through carefully curated strategies and prudent decision-making. By incorporating these ideas into your investment portfolio, you can navigate the complex landscape of finance with confidence and resilience.

Question Bank

What are the key benefits of diversifying investments for low-risk returns?

Diversifying investments helps spread risk across different asset classes, reducing the overall impact of market fluctuations on your portfolio.

How can real estate investment trusts (REITs) offer low-risk returns?

REITs provide a way to invest in real estate without directly owning properties, offering stable income streams and potential capital appreciation.

What metrics should one consider when selecting dividend-paying stocks?

Key metrics include dividend yield, payout ratio, and dividend growth rate, which can indicate the sustainability and reliability of dividend payments.