Embark on a journey into the world of Green Energy Investment Opportunities in Emerging Asia, where sustainable practices meet promising financial prospects. This article delves deep into the current landscape, regulatory frameworks, technological innovations, risks, and emerging trends in the green energy sector across key Asian markets.

Green Energy Investment Landscape in Emerging Asia

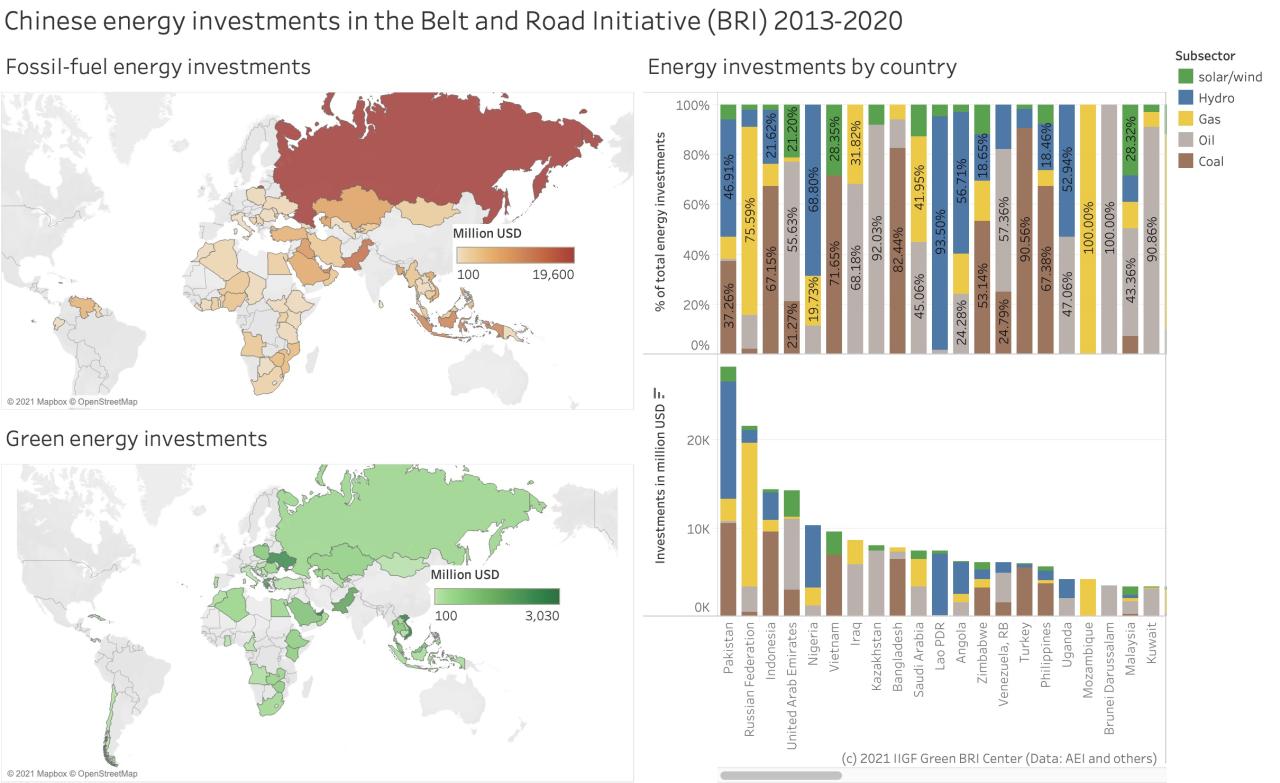

Investments in green energy in emerging Asian countries have been steadily increasing in recent years as governments and businesses alike recognize the importance of transitioning towards sustainable energy sources. This shift is driven by a combination of environmental concerns, energy security, and economic opportunities.

Key Trends and Drivers

- Government Support: Many emerging Asian countries have implemented policies and incentives to encourage investment in green energy, such as feed-in tariffs, tax incentives, and renewable energy targets.

- Technological Advancements: The rapid advancements in renewable energy technologies, such as solar and wind power, have made these sources more cost-effective and reliable, attracting more investments.

- Increasing Demand: The growing energy demand in emerging Asian markets, coupled with concerns about energy security and climate change, has created a strong market for green energy investments.

Comparison of Investment Opportunities

While the overall green energy investment landscape in emerging Asia is promising, there are differences in the opportunities available in each market:

| Market | Opportunities |

|---|---|

| China | Large-scale renewable energy projects, smart grid technologies, and electric vehicles. |

| India | Solar power, wind energy, and energy storage solutions. |

| Vietnam | Hydropower, solar energy, and biomass projects. |

Renewable Energy Policies and Regulations

Government policies and regulations play a crucial role in shaping the renewable energy landscape in emerging Asian countries. These policies not only impact the growth of green energy projects but also influence the attractiveness of these markets for foreign investments.

Regulatory Environment in Emerging Asian Countries

- Each country in emerging Asia has its own set of regulations governing renewable energy projects, which can vary significantly.

- Some countries offer incentives such as feed-in tariffs, tax credits, and subsidies to encourage investment in renewable energy.

- Regulatory stability and clarity are essential for attracting foreign investors, as uncertainty can deter long-term commitments.

Impact of Government Policies on Renewable Energy Growth

- Government policies that prioritize renewable energy sources over traditional fossil fuels can drive the growth of green energy projects.

- Clear targets for renewable energy capacity and generation can provide a roadmap for developers and investors, fostering growth in the sector.

- Policies promoting energy diversification and sustainability can lead to a more resilient and environmentally friendly energy mix.

Attracting Foreign Investments in Green Energy

- A stable regulatory framework that offers transparency and consistency is essential for attracting foreign investments in green energy projects.

- Investor-friendly policies that reduce risks, provide financial incentives, and ensure a level playing field can make emerging Asian countries more appealing for foreign capital.

- Collaboration between governments, financial institutions, and project developers is crucial for creating an environment conducive to foreign investments in renewable energy.

Technological Innovations in Green Energy Sector

Green energy technologies in emerging Asian markets have seen significant advancements in recent years, paving the way for a more sustainable future. These innovations not only contribute to reducing carbon emissions but also offer lucrative investment opportunities for both local and international investors.

Solar Power Innovations

- Solar panels with higher efficiency rates are being developed, allowing for increased energy production in limited spaces.

- Integration of solar tracking systems to optimize sunlight exposure and improve overall energy generation.

- Development of thin-film solar technology, which is more flexible and lightweight, making it suitable for various applications.

Wind Energy Advancements

- Introduction of larger and more efficient wind turbines capable of harnessing stronger winds at higher altitudes.

- Implementation of smart grid technology to enhance the integration of wind power into the existing energy infrastructure.

- Utilization of machine learning algorithms to predict wind patterns and optimize energy output from wind farms.

Energy Storage Solutions

- Development of advanced battery technologies such as lithium-ion and flow batteries to store excess energy for later use.

- Exploration of pumped hydro storage systems and compressed air energy storage to address the intermittency of renewable energy sources.

- Integration of blockchain technology for peer-to-peer energy trading, enabling better utilization of stored energy within communities.

Investment Risks and Challenges

Investing in green energy projects in emerging Asia comes with its own set of risks and challenges that need to be carefully considered before making any financial commitments. These risks can vary from political uncertainties to economic instability and environmental factors that can impact the success of such investments.

Political Risks

Political instability in emerging Asian countries can pose a significant risk to green energy investments. Changes in government policies, regulations, or leadership can directly impact the profitability and sustainability of green energy projects. Investors need to closely monitor political developments and assess how they may affect their investments.

Economic Risks

Economic factors such as currency fluctuations, inflation, and interest rates can also affect the viability of green energy investments. Uncertainties in the economic environment can lead to higher costs of production, delays in project implementation, and reduced returns on investment.

It is essential for investors to conduct thorough financial analysis and risk assessments to mitigate economic risks.

Environmental Risks

Environmental risks such as natural disasters, climate change, and resource scarcity can have a direct impact on green energy projects. For example, extreme weather events can damage infrastructure, disrupt operations, and lead to financial losses. Investors need to incorporate climate resilience strategies and sustainable practices to mitigate environmental risks effectively.

Strategies to Mitigate Risks

To overcome the challenges associated with green energy investments in emerging Asia, investors can implement several strategies. Diversification of investment portfolios, conducting thorough due diligence, partnering with local stakeholders, and leveraging insurance products can help mitigate risks and enhance the resilience of green energy projects.

Emerging Trends in Green Energy Financing

Green energy projects in emerging Asian countries are witnessing a shift in financing models, with new trends emerging to support the growth of sustainable initiatives. Traditional financing methods are being compared with innovative approaches like green bonds and impact investments, bringing about a transformation in the way green energy projects are funded.

Financial institutions and stakeholders play a crucial role in promoting sustainable financing for green energy initiatives, driving the transition towards a more environmentally friendly and economically viable future.

Role of Green Bonds in Green Energy Financing

Green bonds have gained popularity as a sustainable financing tool for green energy projects in emerging Asian countries. These bonds are specifically earmarked for projects that have positive environmental impacts, attracting investors who are looking to support sustainable initiatives. The proceeds from green bonds are used to fund renewable energy projects, offering an alternative financing option to traditional methods.

Impact Investments in Green Energy Sector

Impact investments are another emerging trend in green energy financing, focusing on generating positive social and environmental outcomes alongside financial returns. Investors are increasingly looking to support projects that address climate change and promote sustainable development, driving the growth of the green energy sector in emerging Asian countries.

By aligning financial goals with environmental impact, impact investments play a key role in accelerating the transition to a low-carbon economy.

Role of Financial Institutions and Stakeholders

Financial institutions and stakeholders are actively involved in promoting sustainable financing for green energy initiatives in emerging Asian countries. By offering green financing products, such as loans and investment opportunities, financial institutions play a crucial role in supporting the development of renewable energy projects.

Stakeholders, including governments, industry players, and non-governmental organizations, collaborate to create a conducive environment for green energy financing, fostering innovation and driving the adoption of sustainable practices in the region.

Final Conclusion

In conclusion, Green Energy Investment Opportunities in Emerging Asia present a dynamic and evolving landscape for investors seeking to capitalize on the region's renewable energy potential. With a blend of innovation, policy support, and strategic financing, the future of green energy investments in Emerging Asia looks bright and lucrative.

Common Queries

What are some key trends shaping green energy investments in Emerging Asia?

Key trends include increased government support, technological advancements, and growing investor interest in renewable projects.

How do regulatory frameworks impact foreign investments in green energy projects?

Regulatory frameworks can either attract or deter foreign investments based on stability, transparency, and incentives offered to investors.

What are some common risks associated with investing in green energy projects in Emerging Asia?

Major risks include policy changes, market volatility, and environmental challenges that can affect project viability and returns.

How are financial institutions contributing to sustainable financing in green energy initiatives?

Financial institutions play a crucial role in providing funding, expertise, and guidance to ensure the success and sustainability of green energy projects.