Delving into the realm of global investment trends, this piece explores the transformative impact millennials are having on the traditional investment landscape. From their unique preferences to the adoption of cutting-edge technology, millennials are reshaping the way investments are made worldwide.

As we navigate through the key aspects of millennials' investment decisions and the evolving market opportunities they are exploring, it becomes evident that their approach is not just different but revolutionary.

Millennial Investment Preferences

Millennials, born between 1981 and 1996, have distinct investment preferences that are reshaping global investment trends. Their values, beliefs, and priorities greatly influence how they choose to invest their money. Let's delve into the key investment preferences of millennials and how these factors impact their decisions.

Impact of Social Responsibility

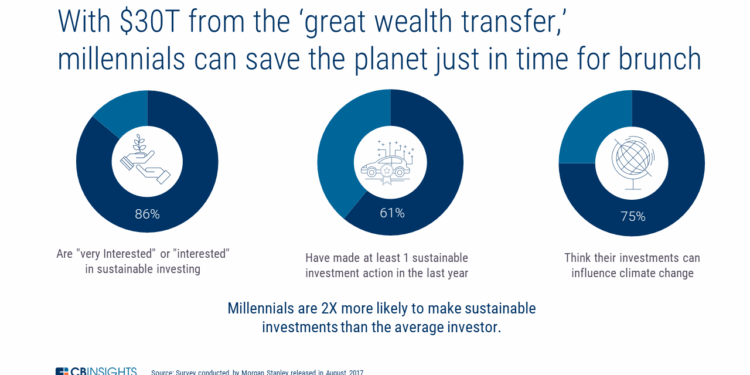

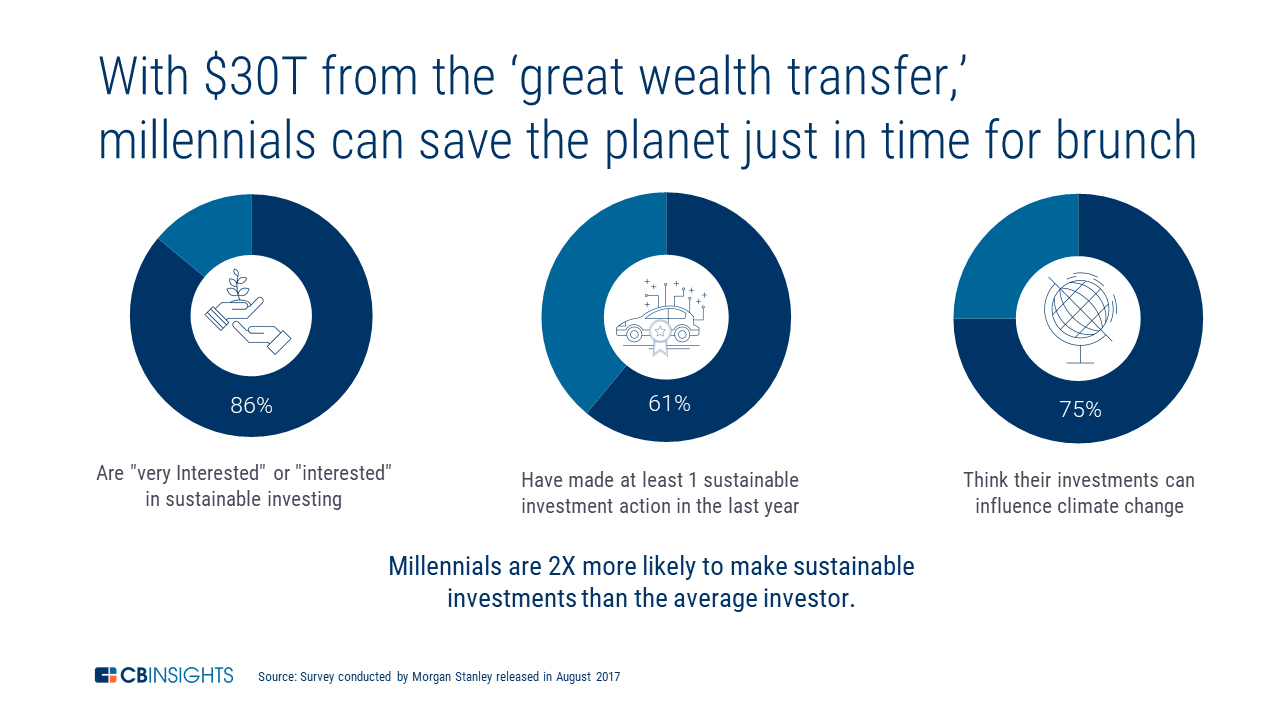

Millennials are known for placing a high value on social responsibility and sustainability when making investment choices. They are more likely to invest in companies that align with their ethical values and support causes they care about. This has led to a rise in socially responsible investing, where financial returns are not the sole focus, but also the positive impact on society and the environment.

Millennials are driving a shift towards a more sustainable and socially conscious investment landscape.

Tech-Savvy Investments

Another key preference of millennials is their inclination towards tech-savvy investments. They are more likely to invest in innovative technologies, such as fintech, artificial intelligence, and clean energy. Millennials are early adopters of new investment platforms and digital tools that offer convenience and accessibility.

This trend is driving the growth of digital investment platforms and robo-advisors tailored to the preferences of tech-savvy millennials.

Preference for Diversity and Inclusion

Millennials also prioritize diversity and inclusion when selecting investment opportunities. They seek companies that promote diversity in their workforce and leadership, as they believe in the importance of representation and equality. This preference extends to investment strategies that support underrepresented communities and businesses owned by women and minorities.

Millennials are reshaping the investment landscape by advocating for more inclusive and equitable opportunities.

Technology and Global Investment Trends

Technology has significantly shaped how millennials approach investing on a global scale. With the rise of digital advancements, millennials are more inclined towards utilizing online platforms and apps for their investment needs, making the process more accessible and efficient compared to traditional methods.

Digital Investment Tools vs. Traditional Methods

- Traditional methods, such as visiting brick-and-mortar financial institutions, have been replaced by digital investment tools that offer convenience and real-time data analysis.

- Millennials prefer using mobile apps and online platforms to manage their investments, allowing them to make quick decisions and monitor their portfolios on the go.

- Fintech companies have revolutionized the investment landscape by providing user-friendly interfaces, personalized recommendations, and automated investment services tailored to millennials' preferences.

Popular Fintech Platforms Among Millennial Investors

- Robinhood: Known for its commission-free trading and user-friendly interface, Robinhood has gained popularity among millennials looking to invest in stocks, ETFs, and cryptocurrency.

- Wealthfront: This robo-advisor platform offers automated investment services based on personalized risk tolerance and financial goals, making it a preferred choice for millennial investors seeking a hands-off approach.

- Acorns: Acorns rounds up everyday purchases to the nearest dollar and invests the spare change in diversified portfolios, making investing effortless and accessible for millennials with limited capital.

Global Market Opportunities

Investing in global markets provides millennials with the opportunity to diversify their portfolios and gain exposure to emerging economies. As technology continues to connect the world, globalization plays a crucial role in expanding investment options for this generation

Emerging Global Markets

- Latin America: Countries like Brazil, Mexico, and Colombia are attracting millennial investors due to their growing middle class and expanding consumer markets.

- Asia Pacific: With countries like China, India, and Vietnam experiencing rapid economic growth, millennials are looking to capitalize on the opportunities in this region.

- Africa: Nations such as Nigeria, Kenya, and South Africa are becoming increasingly attractive for investment as infrastructure improves and consumer spending rises.

Globalization and Investment Opportunities

- Globalization has enabled millennials to easily access international markets through online platforms and mobile apps, making it convenient to invest in different regions.

- By diversifying their portfolios across various countries, millennials can reduce risk and take advantage of growth opportunities in emerging markets.

Impact Investing and Millennials

Impact investing refers to making investments with the intention of generating positive social or environmental impact alongside financial returns. This approach is gaining popularity among millennials who prioritize making a difference in the world through their investment choices.

Companies Leading in Impact Investing

- One example of a company actively engaging in impact investing is Patagonia, a well-known outdoor apparel brand that is committed to sustainability and environmental conservation.

- Another sector where millennials are showing interest in impact investing is renewable energy, with companies like Tesla leading the way in developing sustainable energy solutions.

- Microfinance institutions, such as Kiva, are also attracting millennial investors who want to support financial inclusion and empowerment in developing countries.

Long-Term Implications

Impact investing by millennials has the potential to drive significant changes in the global economy. By directing capital towards businesses that prioritize social and environmental responsibility, millennials are influencing corporate behavior and encouraging a shift towards more sustainable practices. This focus on impact investing could lead to a more equitable and environmentally conscious future, shaping the way businesses operate and contribute to society.

Outcome Summary

In conclusion, the influence of millennials on global investment trends is undeniable. As they actively engage in impact investing, embrace technological advancements, and seek opportunities in diverse markets, the future of investing is undoubtedly in their hands.

FAQ Overview

How do millennials' values shape their investment decisions?

Millennials prioritize social responsibility and sustainability, often choosing investments aligned with their ethical beliefs.

What are some popular fintech platforms among millennial investors?

Platforms like Robinhood, Acorns, and Wealthfront are favored by millennials for their user-friendly interfaces and innovative features.

Why is impact investing significant for millennials?

Impact investing allows millennials to align their financial goals with creating positive social and environmental change, making a difference while earning returns.

How are millennials diversifying their investment portfolios across regions?

Millennials are exploring emerging markets globally and investing in a variety of industries to spread risk and maximize opportunities.