Embark on a journey to discover the secrets of constructing a recession-proof investment portfolio. This guide delves into the intricacies of safeguarding your investments against economic downturns, offering valuable insights and strategies to ensure financial stability in turbulent times.

As we explore the components of a resilient portfolio, you'll gain a deeper understanding of asset allocation, risk management techniques, and the importance of a long-term investment perspective. Prepare to fortify your financial future with expert advice and proven strategies.

Importance of a Recession-Proof Investment Portfolio

Investing in a recession-proof portfolio is crucial to safeguarding your finances during economic downturns. This type of portfolio is designed to minimize losses and maintain stability even when the market is facing challenges.

Impact of Economic Downturns on Traditional Investments

During a recession, traditional investment portfolios heavily weighted in stocks or industries sensitive to economic fluctuations can experience significant losses. For example, stock prices may plummet, real estate values could decline, and interest rates may become unfavorable. This can lead to a substantial decrease in the overall value of the portfolio, putting investors at risk of financial instability.

Importance of Diversification in Building Resilient Portfolios

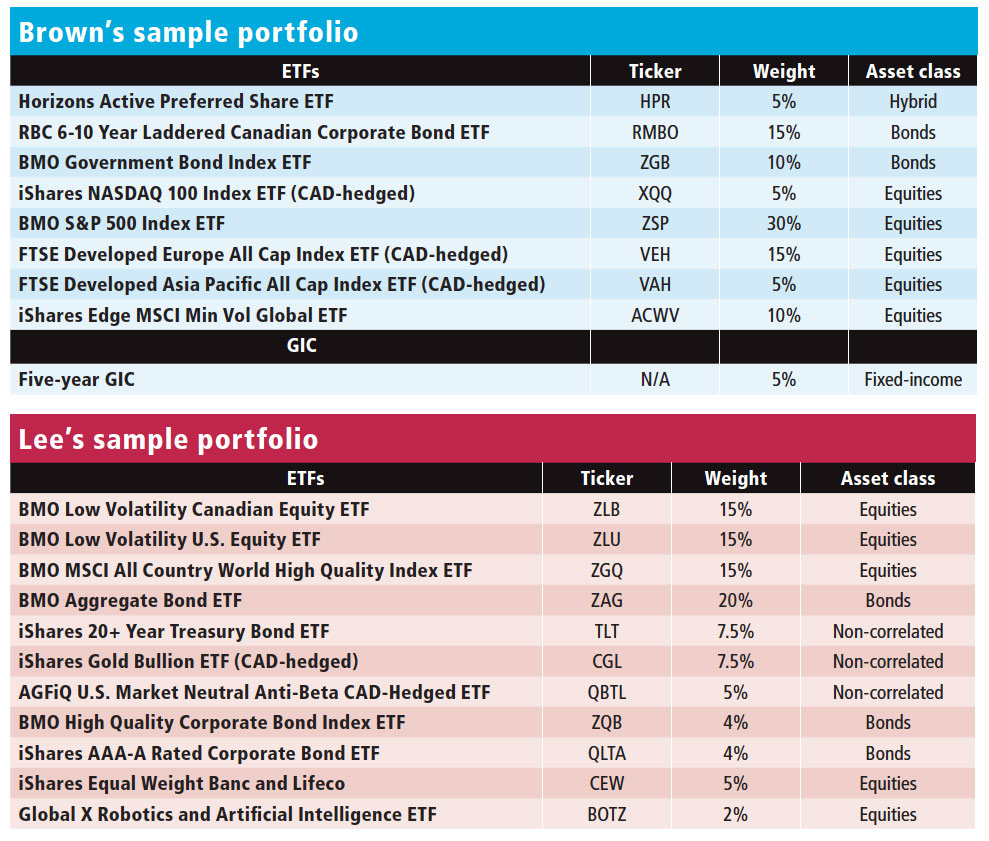

Diversification is key in building a recession-proof investment portfolio. By spreading investments across different asset classes, industries, and geographic regions, investors can reduce risk and minimize the impact of market volatility. For instance, allocating funds to bonds, real estate, commodities, and alternative investments can help balance out losses in one sector with gains in another.

This strategy can provide a cushion during economic downturns and help maintain portfolio performance over the long term.

Asset Allocation Strategies

When building a recession-proof investment portfolio, one of the key considerations is determining the appropriate asset allocation strategies. By diversifying across various asset classes, investors can better protect their investments from economic downturns.Asset allocation refers to the distribution of investments across different asset classes such as stocks, bonds, real estate, and commodities.

Each asset class behaves differently in response to economic conditions, allowing investors to mitigate risk by spreading their investments across a range of assets.

Different Asset Classes for a Recession-Proof Portfolio

- Stocks: Despite their volatility, stocks have the potential for high returns over the long term. Investing in a mix of large-cap, mid-cap, and small-cap stocks can help diversify stock market risk.

- Bonds: Bonds are considered a safer investment during economic downturns due to their fixed interest payments. Government bonds and high-quality corporate bonds are typically favored for stability.

- Real Estate: Real estate investments, such as rental properties or real estate investment trusts (REITs), can provide a steady income stream and act as a hedge against inflation.

- Commodities: Investing in commodities like gold, silver, or oil can provide a hedge against inflation and currency devaluation during economic crises.

Risk Management Techniques

In times of economic uncertainty, it is crucial to implement effective risk management techniques to safeguard your investments. By utilizing strategies such as setting stop-loss orders, having an exit strategy in place, and employing hedging techniques, investors can better protect their portfolios during a recession.

Setting Stop-Loss Orders

Stop-loss orders are predetermined price levels at which an investor will sell a stock to limit losses. By setting stop-loss orders, investors can automatically sell a security when it reaches a certain price, preventing further downside risk. This technique helps investors avoid emotional decision-making during times of market volatility.

Having an Exit Strategy

Having an exit strategy in place involves establishing clear guidelines for when to sell an investment

Utilizing Hedging Techniques

Hedging involves using financial instruments such as options or futures to offset potential losses in a portfolio. For example, an investor can purchase put options to protect against a decline in the value of their stocks. By hedging their positions, investors can reduce their overall risk exposure and mitigate losses during a recession.

Long-Term Investment Perspective

Investing with a long-term perspective is crucial when building a recession-proof investment portfolio. By focusing on the big picture and staying committed to your investment strategy, you can navigate through market downturns with confidence.

Advantages of Maintaining a Disciplined Investment Strategy

- Staying Calm During Volatility: Long-term investors are less likely to panic sell during market downturns, allowing them to ride out the storm and benefit from eventual recoveries.

- Compound Growth: Over time, the power of compounding can significantly boost your investment returns, especially when you reinvest dividends and let your investments grow.

- Diversification Benefits: Long-term investors can take advantage of diversification to spread risk across different asset classes, reducing the impact of any single market fluctuation.

Successful Long-Term Investment Strategies

- Buy and Hold: This strategy involves buying quality investments and holding onto them for the long term, regardless of short-term market fluctuations. Warren Buffett's approach is a classic example of successful long-term investing through buy and hold.

- Dividend Investing: Investing in dividend-paying stocks can provide a steady income stream and potential for capital appreciation over time. Companies with a history of consistent dividend payments are often favored by long-term investors.

- Index Funds: Investing in low-cost index funds that track the performance of the overall market can be a simple yet effective long-term strategy. These funds offer diversification and typically outperform actively managed funds over the long run.

Conclusion

In conclusion, mastering the art of building a recession-proof investment portfolio is essential for weathering financial storms and securing your financial well-being. By implementing the strategies Artikeld in this guide, you can navigate uncertain economic landscapes with confidence and resilience.

Take charge of your financial future today and pave the way for long-term prosperity.

Questions and Answers

What is the significance of diversification in building a recession-proof investment portfolio?

Diversification helps spread risk across different asset classes, reducing the impact of market fluctuations on your overall portfolio.

How can stop-loss orders protect investments during a recession?

Stop-loss orders automatically sell an asset when it reaches a predetermined price, preventing further losses in a declining market.

Why is a long-term investment perspective important for recession-proofing a portfolio?

Long-term investments allow you to ride out market volatility and benefit from compounding returns over time, increasing the resilience of your portfolio.