Exploring the realm of Real Estate Crowdfunding: A Modern Investment Model, this introduction delves into the innovative concept that is reshaping the investment landscape. With its unique characteristics and potential for diversification, real estate crowdfunding offers investors a modern approach to property investment.

Introduction to Real Estate Crowdfunding

Real estate crowdfunding is a modern investment model that allows individuals to pool their resources together to invest in real estate projects. This form of crowdfunding typically takes place through online platforms, making it accessible to a wider range of investors.

Real estate crowdfunding is transforming the investment landscape by democratizing access to real estate investments. It provides opportunities for smaller investors to participate in projects that were previously only available to large institutions or wealthy individuals.

Key Characteristics of Real Estate Crowdfunding

- Accessibility: Allows individuals to invest in real estate with lower capital requirements.

- Diversification: Investors can spread their risk by investing in multiple real estate projects.

- Transparency: Provides investors with detailed information about the projects they are investing in.

- Potential for High Returns: Offers the potential for attractive returns compared to traditional investment options.

Examples of Successful Real Estate Crowdfunding Projects

One notable example of a successful real estate crowdfunding project is the Oculus Rift project, which raised over $2.4 million on the Kickstarter platform. Another example is the St. Regis Hotel project in Aspen, Colorado, which was funded through real estate crowdfunding and delivered strong returns to investors.

Benefits of Real Estate Crowdfunding

Investing in real estate through crowdfunding offers numerous advantages compared to traditional real estate investment models. Not only does it provide a more accessible entry point for investors, but it also offers diversification opportunities and other benefits that make it an attractive option for those looking to invest in real estate.

Access to a wider range of investment opportunities

Real estate crowdfunding platforms allow investors to access a diverse range of real estate projects that they might not have been able to invest in otherwise. This opens up the possibility of investing in different types of properties across various locations, helping investors spread their risk and potentially increase their returns.

Lower investment costs

One of the key benefits of real estate crowdfunding is the ability to invest in real estate with lower capital requirements. By pooling funds with other investors, individuals can participate in larger real estate projects that would typically be out of reach if they were to invest on their own.

This lower barrier to entry makes real estate investing more accessible to a wider range of investors.

Passive income and portfolio diversification

Real estate crowdfunding offers investors the opportunity to generate passive income through rental payments or property appreciation. By investing in multiple real estate projects through crowdfunding, investors can diversify their portfolios and reduce the risk associated with having all their investments tied to a single property or location.

This diversification can help protect against market fluctuations and economic downturns.

Transparency and reduced administrative burden

Real estate crowdfunding platforms provide investors with transparent information about the projects they are investing in, including financial projections, property details, and investment terms. This level of transparency can help investors make informed decisions and feel more confident about their investment choices.

Additionally, the platform handles the administrative tasks associated with real estate investments, such as property management and legal matters, reducing the burden on individual investors.

Liquidity and flexibility

Unlike traditional real estate investments, which can be illiquid and require a long-term commitment, real estate crowdfunding offers greater liquidity and flexibility. Investors can typically exit their investments before the project is completed, providing them with the option to liquidate their holdings if needed.

This flexibility allows investors to adjust their portfolios according to their financial goals and market conditions.

Risks Associated with Real Estate Crowdfunding

Real estate crowdfunding, like any investment, comes with its own set of risks that investors should be aware of. Understanding these risks is crucial in making informed decisions when participating in crowdfunding projects.

Platform Risk

Platform risk refers to the potential for the crowdfunding platform itself to face financial or operational challenges, leading to investor losses. Factors such as the platform's reputation, track record, and regulatory compliance can impact the overall success of investments. To mitigate platform risk, investors should conduct thorough due diligence on the platform, check for regulatory approvals, and review past performance data.

Project-Specific Risks

Project-specific risks are associated with the individual real estate projects funded through crowdfunding. These risks can include market fluctuations, unexpected construction delays, or changes in local regulations that may affect the project's profitability. Diversification across multiple projects can help spread out project-specific risks and reduce overall exposure.

Investors should also consider the location, developer reputation, and project timeline when evaluating potential investments.

Strategies to Mitigate Risks

- Conduct thorough due diligence on both the crowdfunding platform and individual projects.

- Diversify investments across multiple projects to reduce concentration risk.

- Stay informed about market trends, regulatory changes, and economic indicators that may affect real estate investments.

- Set realistic investment goals and timelines, aligning them with your risk tolerance and financial objectives.

- Regularly monitor the performance of your investments and be prepared to adjust your portfolio as needed.

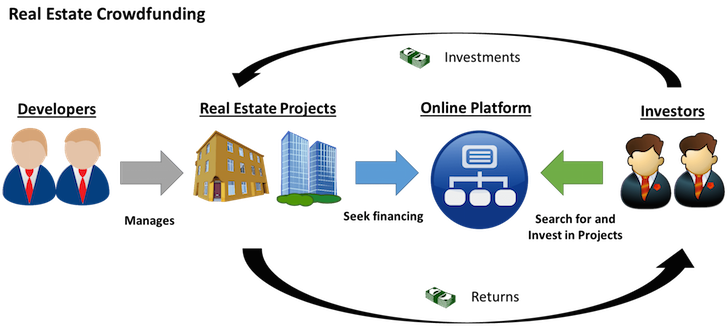

How Real Estate Crowdfunding Works

Real Estate Crowdfunding works by allowing individual investors to pool their funds together to invest in real estate projects. This modern investment model is facilitated through online platforms that connect investors with various real estate opportunities.

Investing Process in Real Estate Crowdfunding

- Investors browse through different real estate projects listed on crowdfunding platforms.

- They select a project they are interested in and decide on the amount they want to invest.

- Investors contribute their funds towards the chosen project, becoming partial owners.

- As the project generates income (rental payments, property sales, etc.), investors receive returns proportionate to their investment.

Role of Crowdfunding Platforms

- Crowdfunding platforms act as intermediaries, vetting and listing real estate opportunities for investors.

- They provide a platform for investors to explore, analyze, and invest in various projects.

- Platforms handle administrative tasks, such as legal documentation and fund distribution, streamlining the investment process.

Investment Structures in Real Estate Crowdfunding

- Equity Investments:Investors become partial owners of the property and receive a share of the rental income or profits upon sale.

- Debt Investments:Investors act as lenders, providing loans to real estate developers in exchange for fixed interest payments.

- Hybrid Investments:Combination of equity and debt structures, offering investors a mix of ownership and fixed returns.

Regulations and Legal Considerations

When it comes to real estate crowdfunding, there are specific regulations and legal considerations that both investors and project sponsors need to be aware of to ensure compliance and success in their campaigns.

Regulatory Framework

In the United States, real estate crowdfunding is governed by the Securities and Exchange Commission (SEC) under Regulation Crowdfunding (Reg CF) and Regulation A+ (Reg A). These regulations dictate how offerings can be made to investors, the amount that can be raised, and the disclosure requirements for project sponsors.

Legal Requirements

Investors participating in real estate crowdfunding campaigns must meet certain criteria, such as income and net worth thresholds, to qualify as accredited investors. On the other hand, project sponsors must provide transparent information about the investment opportunity, including property details, financial projections, and risks involved.

Compliance Impact

Ensuring compliance with regulations is crucial for the success of real estate crowdfunding campaigns. Failure to adhere to the legal requirements can result in penalties, fines, or even the shutdown of the campaign. By following the regulatory framework and meeting legal obligations, both investors and project sponsors can build trust and credibility in the crowdfunding platform, attracting more participants and increasing the chances of a successful funding round.

Closure

In conclusion, Real Estate Crowdfunding: A Modern Investment Model presents an exciting opportunity for investors to engage in property investment like never before. With its benefits, risks, and regulatory considerations, this modern investment model opens doors to a new era of real estate investment.

FAQ Corner

What are the key characteristics of real estate crowdfunding?

Real estate crowdfunding involves multiple investors pooling funds to invest in real estate projects, typically through online platforms.

How does real estate crowdfunding differ from traditional real estate investment?

Real estate crowdfunding provides access to smaller investments, diversification opportunities, and easier entry into the real estate market compared to traditional models.

What are platform risk and project-specific risks in real estate crowdfunding?

Platform risk refers to the potential failure of the crowdfunding platform, while project-specific risks are related to the success or failure of individual real estate projects.

What is the role of regulatory frameworks in real estate crowdfunding?

Regulatory frameworks help protect investors and ensure compliance with laws, influencing the success and operation of real estate crowdfunding campaigns.